Disclaimer: We are Digital Referral Associate (DRA) partner of Aditya Birla Capital. DRA Code: 10989

Open a Trading and Demat account instantly

Bring down your trading cost with attractive Brokerage and Demat AMC plans

Aditya Birla Money (ABM) partners with its customers and assists them in the journey of Wealth Creation by empowering them with the power of Equity and varied Financial Instruments. They offer investments and trading in Stock and Securities through various affiliations with Stock Exchanges. They provide a wide range of solutions in Equity, Derivative, Currency, Debt and Commodity Broking, Portfolio Management Services, Depository and other financial products. As a depository participant, Aditya Birla Money have equity assets under custody worth around Rs. 28,000 crores that cater to over 3 lakh investors,with pan-India distribution network of 40+ branches and 700+ franchisee offices.

Investment Options:

Wide range of investment options include trading in Equity, Derivative, Currency and Debt segment on NSE & BSE. Commodity hedging and trading services on MCX and NCDEX exchanges. Also registered as a Portfolio Manager with SEBI, which offers Discretionary PMS & Non-Discretionary PMS services to its large base of HNI investors.

Range of products & services:

- Trading & Trade analysis platforms: State-of-the-art, user-friendly and secured trading platforms such as Advanced trading platform, Mobile Invest & Express trade offer seamless, hassle-free and enhanced trading experience to customers. Portfolio tracker is an integrated live portfolio tracker with the dual benefit of tracking and transacting through a single interface.

- Research Recommendations: Highly qualified and trained equity & derivative research unit offers comprehensive research reports & trading strategies, enabling you to make the right investment decisions and maximizing your profitability.

- Portfolio Management Services: Within the D-PMS offerings, ABM Core & Satellite is the flagship scheme, which intends to benefit from both the secular earnings growth, as well as from irrational (but transient) market behavior & special situations driven opportunities. On the other hand, the ND-PMS proposition is customized to suit individual investors’ Risk-Return profile, while keeping the stock-selection based investment philosophy intact i.e. investing in secular growth companies with economic and competitive advantages.

- Support Services: Dedicated customer service desk at your disposal.

DOCUMENTS NEEDED

- Pan Card

- Adhar Card (Adhar linked with mob)

- Photo (need to upload online)

- Signature on plain white paper

- Cancel Cheque

- Mobile Number

- Email ID

- 6 month Bank Account Statement in pdf

AMC & Brokerage charges (LAST UPDATED NOVEMBER 02, 2023)

Intra-Day & Futures = 1.5 paise or 0.015%

Delivery = 15 paise or 0.15%

Option = Rs. 30 Per Lot (at the time of account opening (And if in case after activating FNO , brokerage by default mapped 100 Rs per lot then we need to modify manually so just keep checking once after account opens.)

AMC Charges :-

● AMC 555 for 5 Years

● Lifetime 999+ GST

Other Charges

● DP Selling Charges Rs.25 on Selling on Delivery.

● Minimum Brokerage Rs. 2 Paisa (0.02%) or whichever higher.

Open a Trading and Demat account instantly

Bring down your trading cost with attractive Brokerage and Demat AMC plans

Disclaimer: We are Digital Referral Associate (DRA) partner of Aditya Birla Capital. DRA Code: 10989

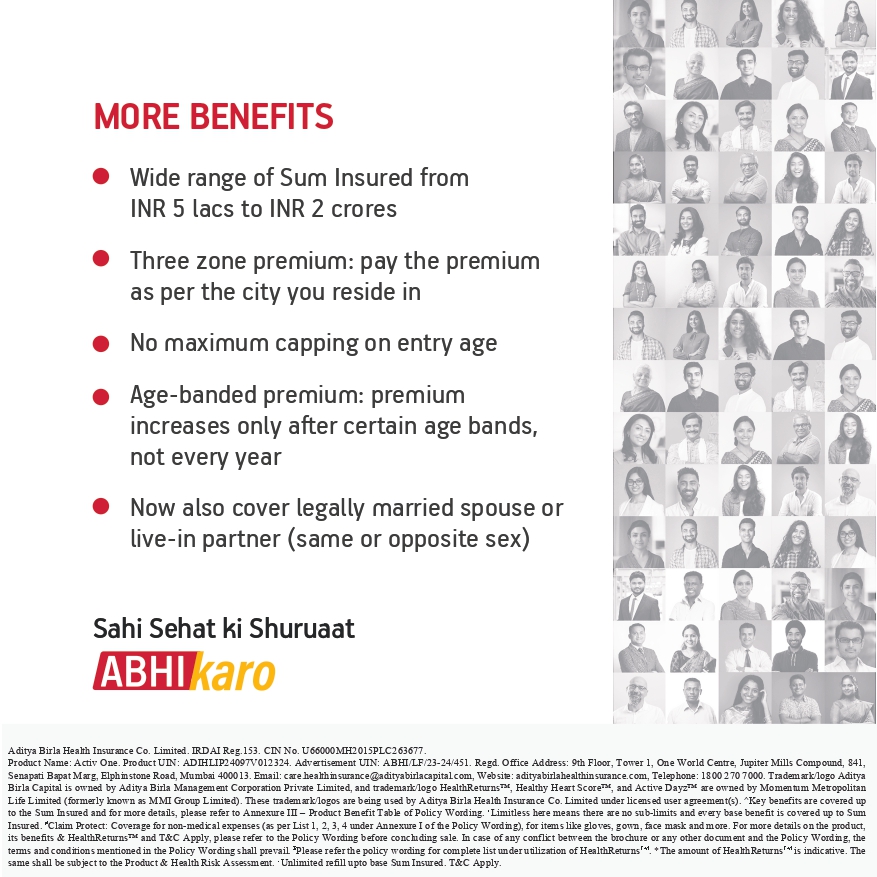

Aditya Birla Health Insurance

Last Updated on February 20, 2024 by Admin

Leave a Reply