Description

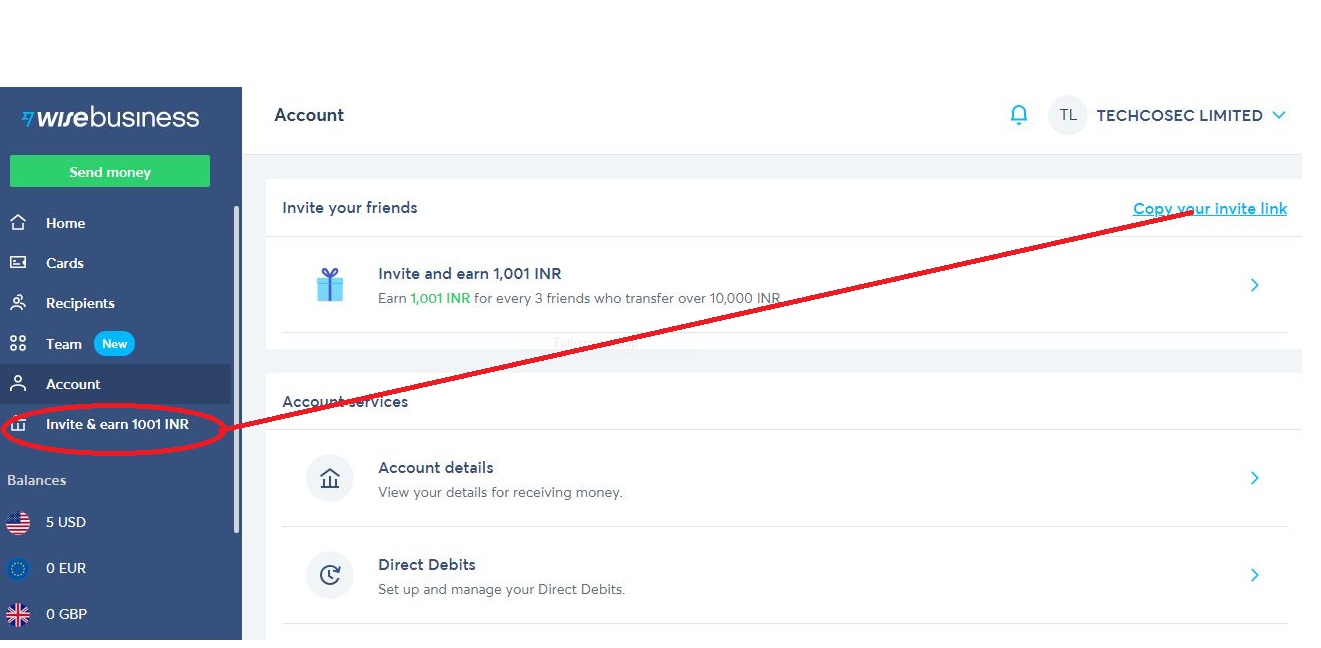

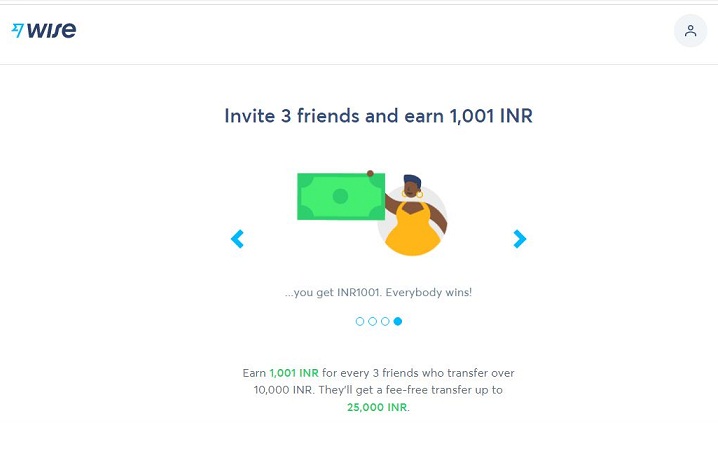

If you are a Wise (formerly TransferWise) customer and want to refer this banking service to your acquaintances, you may join Wise referral program.

In case you are a blogger, publisher and wish to get associated with promoting Wish banking services, you might like to join Wise affiliate program listed in Partnerize (an affiliate marketing marketplace bringing merchants/advertisers and publishers together).

It is best to promote those affiliate programs that you yourself are using. You can open a Wise banking account as individual or business. Just after signup, you get the feature of international money transfer. In order to get a bank account (with bank account no., Swift code, Visa debit card), there is a one time fee. This was 16 British Pounds for opening a business bank account of a limited company registered in UK from India. No need to visit the bank physically. Even passport/driving license not mandatory. With a national id (Aadhar/PAN) and residential proof (such as bank statement, utility bills) it is possible to have a full fledged bank account as an individual or a business. Also UK phone no. not mandatory. Being designed for global small businesses in mind, the team behind Wise understands the needs and so host of small business friendly features including zero balance account (i.e., no mandatory minimum balance requirement).

Last Updated on March 11, 2024 by Admin

Reviews

There are no reviews yet.